The Emotional Side of Debt

and How to Fix It

Money isn’t just about numbers on a page—it’s emotional. Anyone who has ever stared at a stack of bills or avoided logging into their bank account knows the heavy weight debt can put on your shoulders. Debt doesn’t just strain your finances; it impacts your sleep, your relationships, and even your health.

The good news? You’re not alone—and there are tools to help. One of the most powerful ways to reduce both the financial and emotional stress of debt is consolidation. By rolling multiple bills into one manageable monthly payment, debt consolidation gives you not just a financial fresh start, but a psychological one as well.

Let’s explore the psychology of debt, how it affects your well-being, and why consolidation can make you feel like you can finally breathe again.

The Emotional Burden of Debt

Debt creates more than just financial pressure—it’s a constant mental load.

- Anxiety and stress: When bills pile up, it can feel like there’s no way out. That persistent worry takes a toll on your ability to focus and function day to day.

- Shame and guilt: Many people blame themselves for their debt, even though factors like medical bills, job loss, or rising costs of living are often out of their control.

- Decision fatigue: Juggling multiple due dates, interest rates, and minimum payments can feel overwhelming, making it hard to know where to start.

- Strained relationships: Debt stress doesn’t stay contained—it can spill into marriages, friendships, and family life.

Psychologists call this the “debt-stress cycle.” The more stressed you feel about your debt, the harder it becomes to make clear, confident financial decisions—leading to more avoidance, late payments, and even deeper debt.

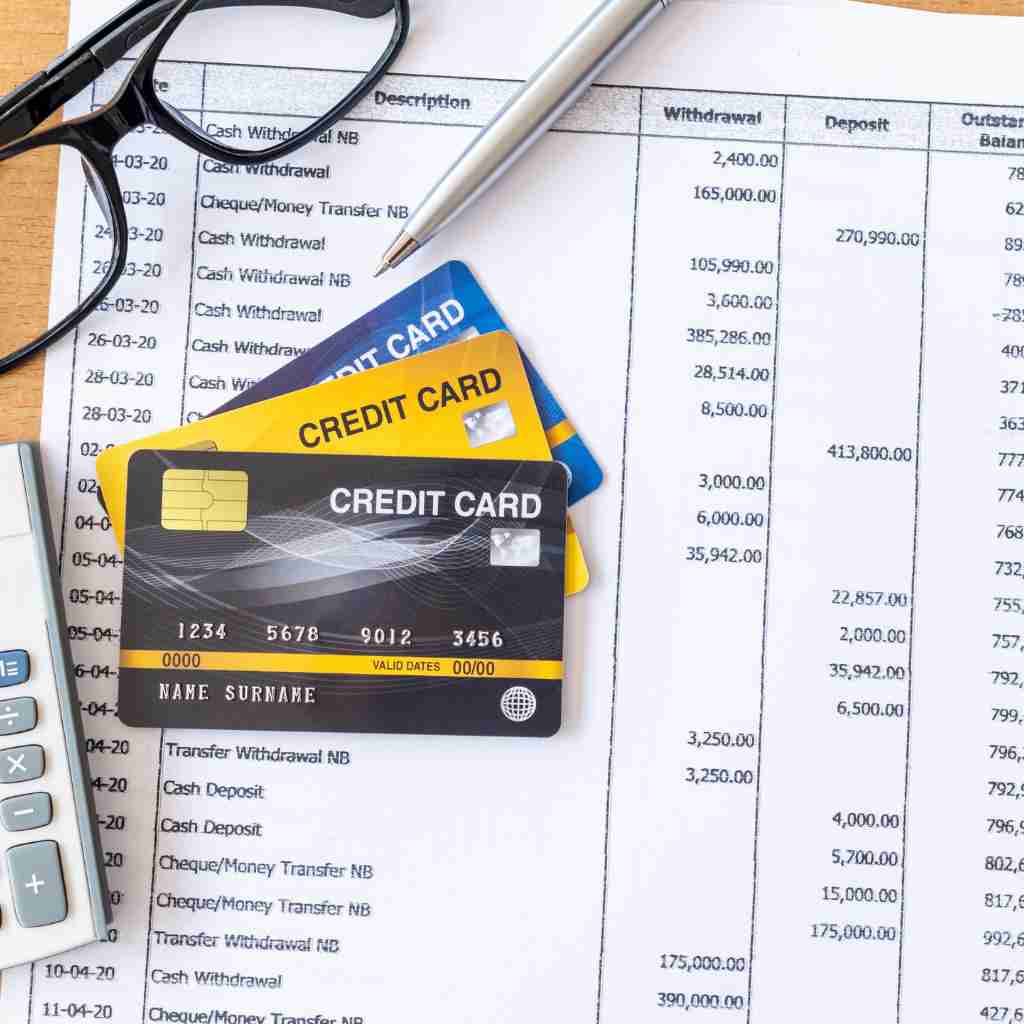

Why the Mind Loves Simplicity

One of the reasons debt feels so overwhelming is the sheer complexity. Let’s say you’re managing five different credit cards, a personal loan, and maybe a lingering medical bill. Each has its own due date, minimum payment, and interest rate. Your brain has to juggle all of that—and it’s exhausting.

Humans are wired to seek clarity and simplicity. Studies show that when people face too many choices or tasks at once, their stress levels spike. Debt consolidation taps into this psychology: instead of five or six bills, you’re down to one payment, one due date, and one clear path forward.

That mental clarity reduces the “clutter” in your head. It doesn’t just improve your finances—it gives you back emotional energy you can redirect toward your career, relationships, and future goals.

The Confidence Factor: Regaining Control

Another hidden burden of debt is the feeling of being out of control. When minimum payments barely make a dent in your balances, it can seem like you’re running in place with no finish line in sight. That sense of powerlessness is one of the heaviest psychological weights debt brings.

Debt consolidation helps restore a sense of control by:

- Creating a clear timeline: With one loan, you know exactly how long it will take to pay everything off.

- Providing structure: Instead of scattering your efforts, all your energy goes toward one solution.

- Offering progress you can see: Watching one balance go down month after month feels much more rewarding than trying to chip away at multiple accounts.

Psychologists know that visible progress is motivating. That’s why people stick to exercise programs, savings challenges, and yes—even debt repayment plans—when they can actually see themselves moving forward. Consolidation gives you that sense of traction.

Debt and Mental Health: Breaking the Cycle

It’s no secret that debt and mental health are deeply linked. According to studies, people with high levels of unsecured debt are significantly more likely to experience anxiety and depression. In some cases, financial stress even contributes to physical symptoms like headaches, insomnia, or high blood pressure.

This is where debt consolidation becomes more than just a financial tool—it’s a wellness strategy. When you’re no longer juggling late fees, unpredictable balances, or creditor calls, you can focus on healing your mind as well as your wallet.

Imagine going to bed at night knowing:

- You only have one bill to remember.

- The interest rate is lower, so you’re saving money each month.

- There’s a set payoff date—you can see the finish line.

That shift in mindset often leads to reduced anxiety, better sleep, and renewed confidence to plan for the future.

The Ripple Effect: More Than Just Money

The benefits of debt consolidation extend beyond peace of mind—they ripple into nearly every area of life:

- Relationships improve: When money fights aren’t dominating conversations, couples and families can focus on shared goals.

- Productivity rises: Reduced stress frees up mental space to concentrate at work or pursue side projects.

- Health rebounds: Less financial anxiety often means better sleep, lower stress hormones, and improved overall well-being.

- Future planning becomes possible: Instead of being stuck in survival mode, you can think about savings, investments, or that dream vacation.

In other words, debt consolidation doesn’t just help you pay down balances—it helps you reclaim your quality of life.

Common Misconceptions About Consolidation

Even with all these benefits, some people hesitate to consolidate because of myths they’ve heard. Let’s clear a few of those up:

- “It’s just moving debt around.”

Not true. With a lower interest rate, consolidation saves you money over time—and one payment makes repayment far easier to manage. - “It will hurt my credit.”

In fact, consolidation often improves credit in the long run. By paying off multiple accounts and making consistent payments on the new loan, your credit profile can strengthen. - “It’s only for people who are drowning.”

Consolidation is a proactive move. Even if you’re not behind, it can help you get ahead by lowering costs and simplifying repayment.

💡 If you’ve been wondering whether consolidation is right for you, now is a great time to speak with a Rocketship Financial specialist. Call 888-603-1007 to explore your options.

How Rocketship Financial Makes Consolidation Stress-Free

At Rocketship Financial, we understand that debt isn’t just numbers—it’s personal. That’s why our process is designed to take the weight off your shoulders:

- Apply online with your basic information.

- Connect with a financial specialist who reviews your situation and walks you through your options.

- Complete all documents securely and conveniently online.

- Choose your loan and sign electronically.

- Pay off your existing debts with the funds provided.

- Make one simple monthly payment toward financial freedom.

Our specialists aren’t just here to offer loans—they’re here to listen, answer your questions, and help you feel confident about the path forward. Thousands of people have already trusted Rocketship to help them simplify debt and reduce stress.

Final Thoughts: Breathing Easier Starts Here

Debt is more than a financial challenge—it’s a psychological one. The constant stress, worry, and exhaustion of juggling multiple payments can weigh down even the strongest person. But it doesn’t have to stay that way.

Debt consolidation can give you more than a single monthly payment—it can give you peace of mind, renewed confidence, and the ability to finally look toward the future without fear.

If you’re ready to simplify your debt and breathe easier, Rocketship Financial is here to help. Call us today at 888-603-1007 or apply online to get connected with a financial specialist who can walk you through your options. Your path to financial clarity starts with one simple step.

🚀 Ready to make your move?

If you’re thinking about debt consolidation, don’t guess—get expert advice. Contact Rocketship Financial today to see what works best for your financial situation.

📞 Talk to a loan expert or get a free quote at rocketshipfinancial.com

About Rocketship Financial

From personalized loan options and debt consolidation solutions to transparent support every step of the way, we help thousands of customers accelerate toward their goals—on their terms.

At Rocketship Financial, we believe financial freedom should be accessible, fast, and built around your life. That’s why we provide a seamless online experience, competitive rates, and a commitment to service that puts your needs first.

Looking for a smarter, simpler way to fund your future?